Market Recap

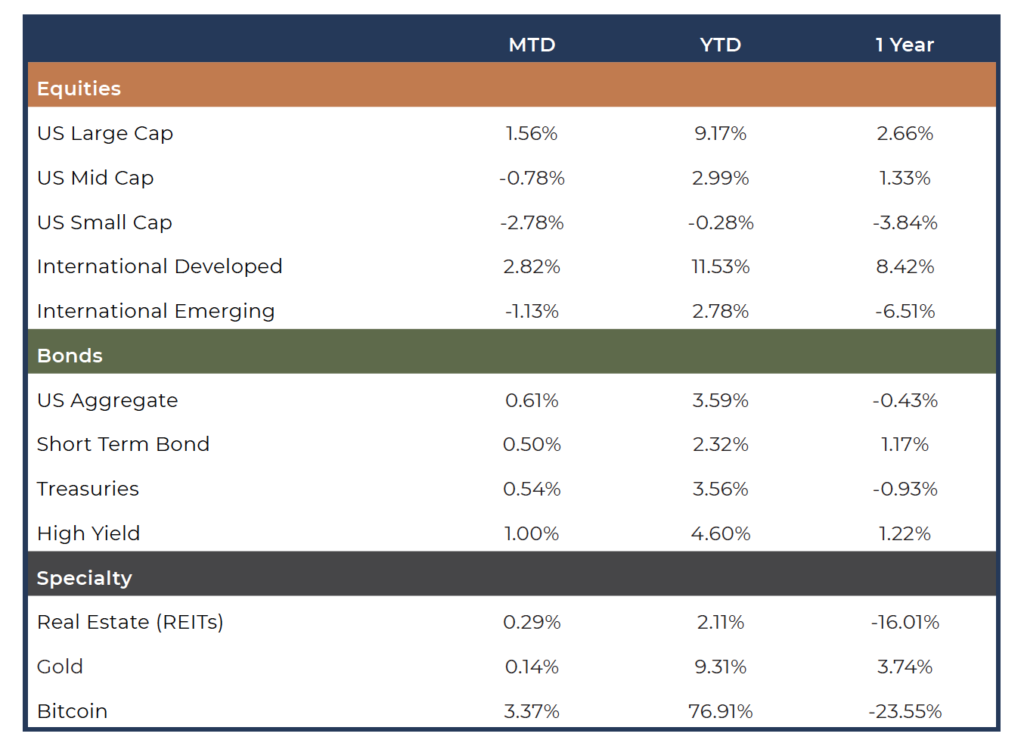

Stocks and bonds experienced some choppiness but finished higher in April. The stock market, as measured by the S&P 500, was up 1.6%, but the market’s advance is becoming narrower, where fewer stocks are participating in the upward movement. Lower market cap indices, such as the S&P Small Cap and Mid Cap indices were down 2.9% and 0.5% for the month, respectively. This suggests that the underlying foundation of the market may not be as strong as it seems by just looking at the S&P 500. In the table below, note the disparity in year to date performance between large caps and small to mid-cap stocks.

The following is a summary of our key observations over the past month and the impact on our outlook:

▶ The regional banking crisis persists, as we continue to witness additional bank failures

▶ Fed policy goals remain the same, but data suggests we could be nearing an end to this tightening cycle

▶ Inflation continues to fall, but we remain far away from the Fed’s long-term target

▶ The need to raise the debt ceiling has been an issue for several months now, but we are getting close to crunch time and need a resolution

▶ The liquidity backdrop of the economy and the markets is tight with money supply contracting, the implementation of quantitative tightening, and the reduction of bank lending

▶ Gold continues to move higher with a favorable backdrop