What Happens To Stocks After the Fed Stops Hiking Rates?

Hopefully, you are currently enjoying a quieter than normal period as 2022 winds down.

The Fed is most likely getting close to the end of their rate hikes, although our best guess is it could be a while before they cut rates.

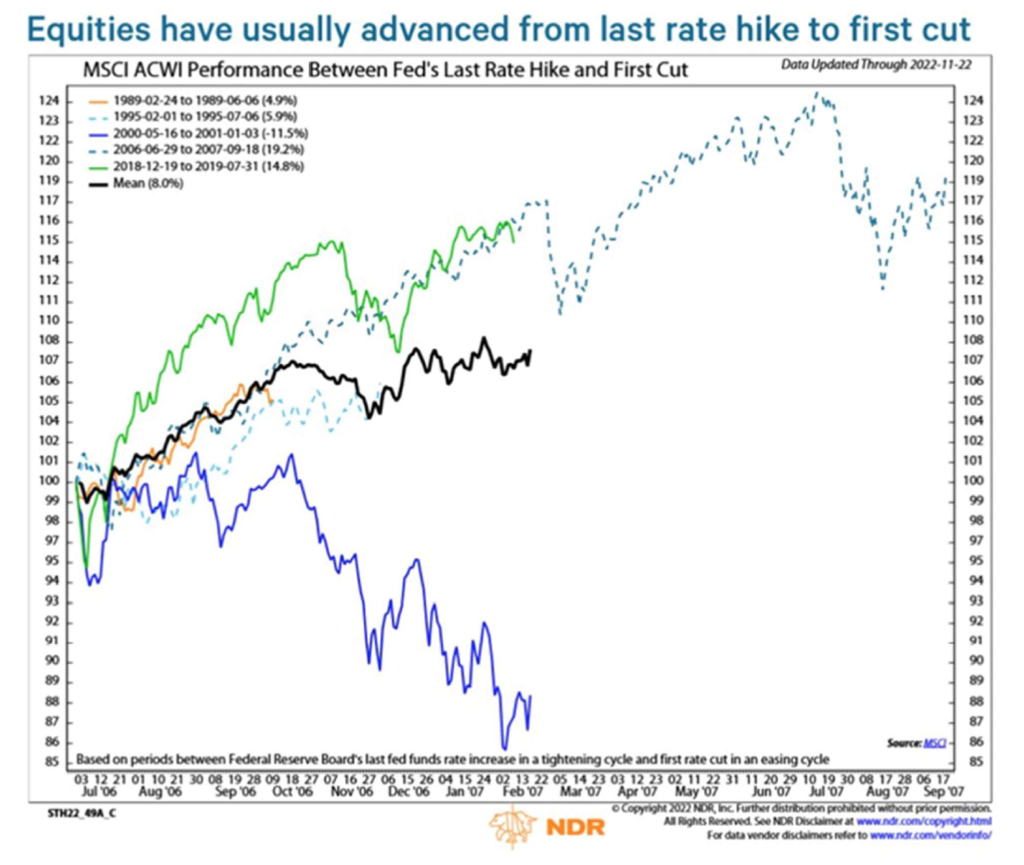

Per the chart below, we find that that in four out of the last five rate hiking cycles stocks were higher between the last hike and when the Fed began to cut rates.

The one notable exception was when the Fed last hiked in 2000, early in a secular bear market. There have been many comparisons with current times and the tech bubble. However, if we are not entering a major secular bear market stocks could benefit from the Fed getting closer to it’s terminal rate.