4th Quarter Market Recap

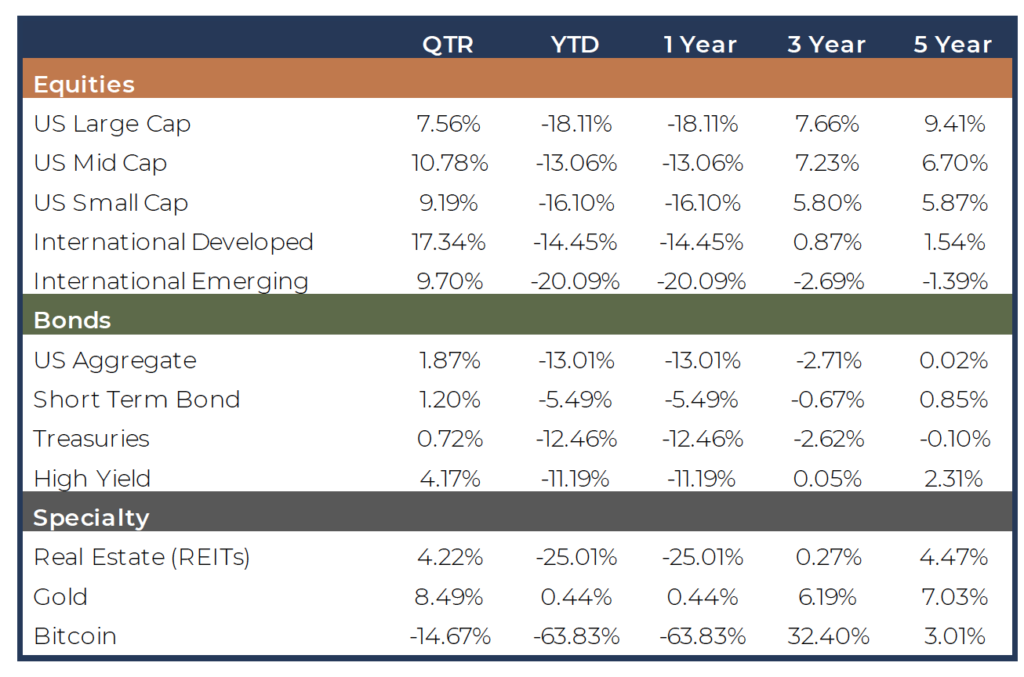

While the year 2022 ended much like it started with some stock market weakness in December, the fourth quarter in its entirety provided a bit of relief to investors with the S&P 500 finishing up north of 7% for the quarter. Let’s begin with a review the performance of some of the key barometers of the financial markets for 2022.

In 2022, the financial markets performance and news flow were dominated by the following headlines: 1) Inflation surging to multi-year high; 2) The policy response by the Federal Reserve to combat inflation; and 3) The rapid increase in interest rates and corresponding impact on bond prices and balanced portfolios.

Throughout 2022, we have discussed inflation and the policy response to it. But now, it is time to turn our attention to the next chapter and identify both the opportunities and challenges ahead in 2023. Below is a summary of our thoughts as we embark on the new year.

▶ We expect 2023 to be a year of transition, with gradual fading of inflation pressures, allowing policymakers and market participants to take a more balanced approach to assess the impacts on economic growth, the labor market, and corporate earnings.

▶ The timing of that transition, however, remains unclear and is likely to be defined by the amount of damage done to the economy by this tightening cycle.

▶ Behind the scenes, US and global money supply is falling at unprecedented rates as liquidity is being drained from the financial system.

▶ The combined and cumulative effect of rate hikes and reduced financial system liquidity should be sufficient to bring inflation down and quell economic growth, but there remains uncertainty with how fast inflation will subside and how much the economy will slow.