Where is all the Cash Going?

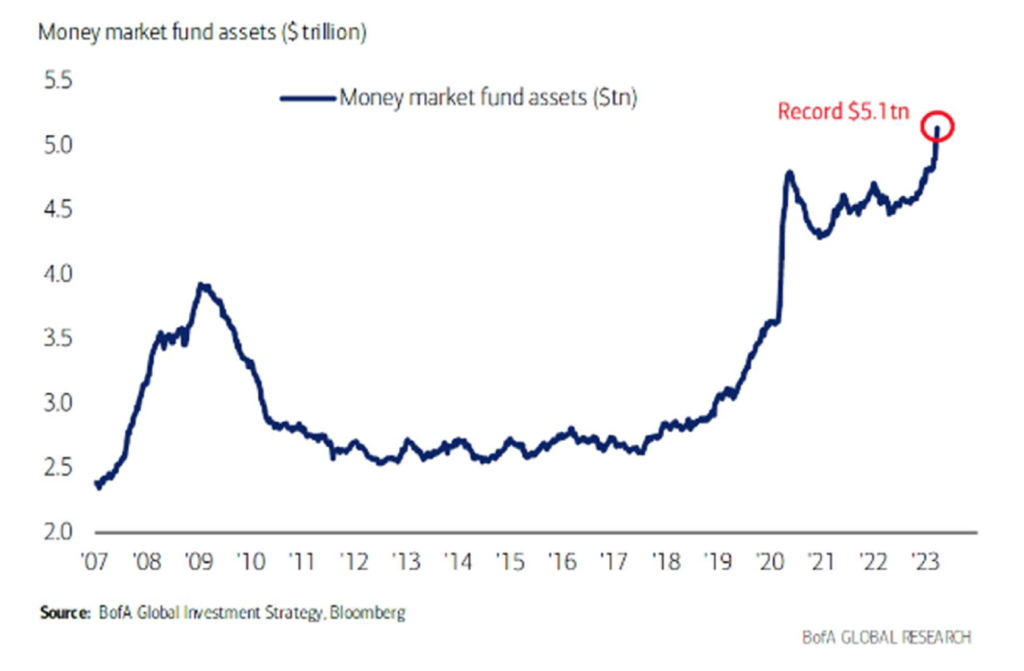

Cash has understandably been finding its way to money market funds over the past year as they began to offer more attractive yields. However, as we see below, assets in money markets has spiked in recent weeks. This has likely been due to general market fears and more recently the bank crisis.

What we find interesting is that the spike in money market assets peaked in 2009 and 2020, which turned out to be the low point for stocks. It is not uncommon when the point of most pessimism and flight to safety turns out to be one of opportunity. Of course, we will only know in hindsight at what level money market assets peak in this cycle. They could still go higher from here, just as stocks could go lower. However, current sentiment is negative enough that any positive surprise could catch some off guard.