January 2023 Market Recap

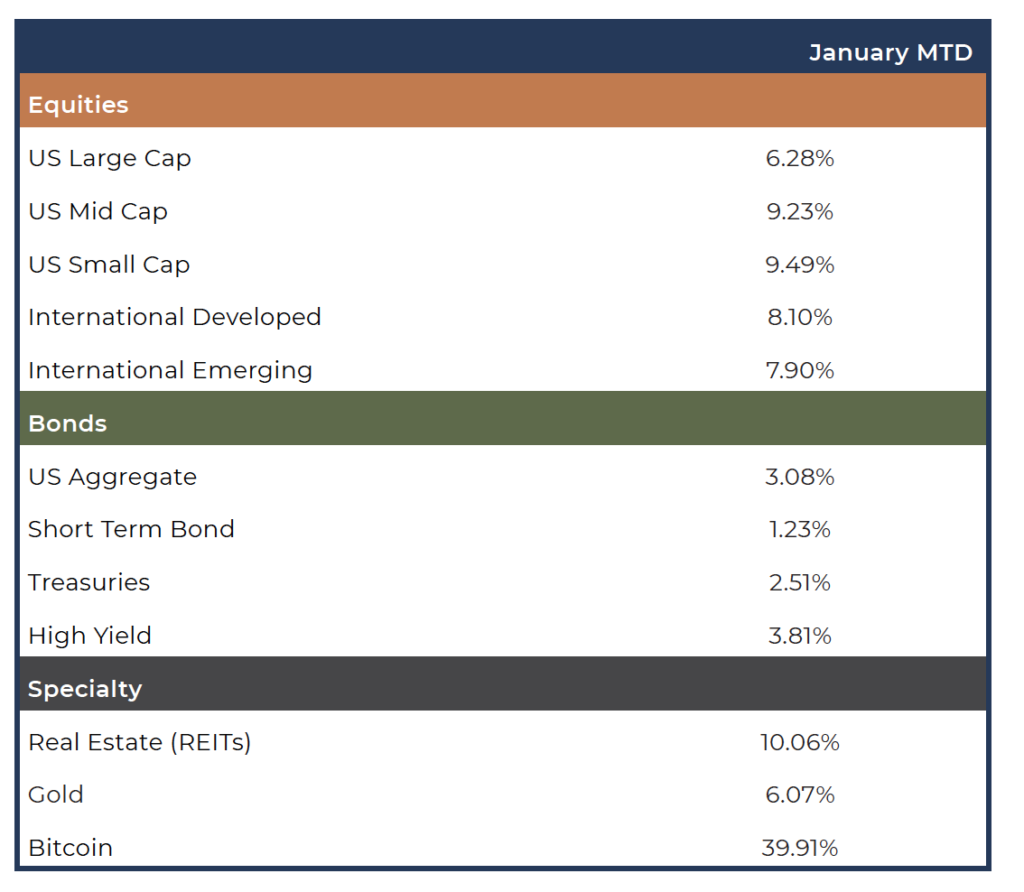

We kicked off the New Year with a nice rally in the financial markets across most asset categories, including stocks, bonds, gold and precious metals, and international stocks (both developed and emerging markets). Let’s review the performance of our key market barometers for the month of January.

While we saw solid broad-based stock performance in January, the strongest performance was witnessed among those subsets or groups that were hit the hardest in 2022. For instance, compared to the S&P 500 return of 6.3% in January:

▶ “Profitless technology companies” were up 21%

▶ High beta stocks outperformed low beta stocks, up 15.2% vs 0.2%

▶ High Short Interest stocks outperformed low short interest, up 12.4% vs 3.7%

▶ Low dividend stocks outperformed high dividend stocks, up 12.2% vs 6.0%

▶ Small Caps outperformed large caps, up 9.5% vs 6.3%

▶ Bitcoin was up 39%, after being down 64% in 2022

By all accounts, January was a “risk-on” type of market, which leads to the logical question as to whether this rebound in “risk-on” assets is sustainable and represents the start of a new bull market, a rally within the same 2022 bear market similar to what we witnessed last June thru mid-August, or just part of an ongoing bottoming process for US stocks. Here is a summary of our thoughts on the economy and financial markets: