Market Recap

One of Wall Street’s adages – the market does what it needs to do to prove the majority wrong – came true in the first half of 2023. Coming into the year and dating back to the October 2022 lows, investor and consumer sentiment had hit rock bottom, close to levels not seen since 2008-2009. In spite of, or perhaps because of, the pessimism, the market staged one of its best first halves on record. The S&P 500 jumped 15.9%, the best since 2019 and 2nd best this century. Meanwhile, the tech-heavy Nasdaq Composite rose 31.7%, its strongest start since 1983 and third best since data began in 1972. The stock market’s quick recovery from the regional banking crisis brought many skeptics off the sidelines.

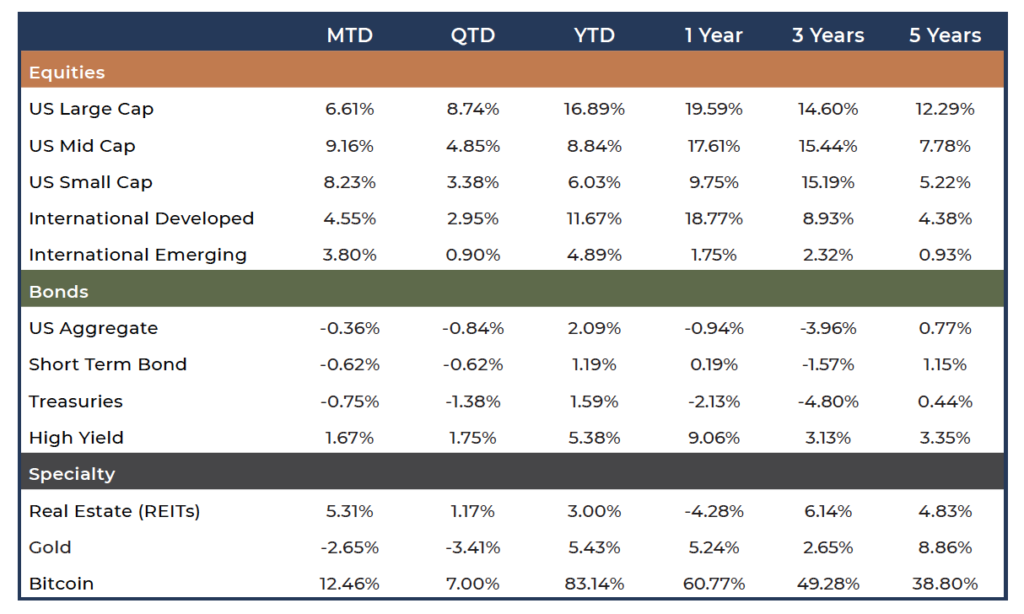

In the fixed income markets, some recent economic datapoints have been “less bad” and surprised to the upside. We saw rates across the yield curve tick up, resulting in negative returns for the quarter, except for high yield bonds.

The following is a summary of our key observations over the quarter and the impact on our outlook:

▶ Mega-Cap stocks have contributed the lion’s share of performance to the S&P 500 in the first half of the year, significantly outperforming the broader market of stocks.

▶ After a pause in rate hikes, Fed policy may once again be taking center stage, as recent economic data has been more positive, potentially prompting future rate hikes.